Advanced Fund Selection Tools

Our institutional-grade tools help you find the perfect funds for your portfolio

Advanced Fund Screener

Filter through thousands of funds using our comprehensive screening tool with 50+ criteria to find investments that match your strategy.

- Filter by performance metrics (1Y, 3Y, 5Y returns)

- Sort by expense ratio, turnover, or manager tenure

- Screen for ESG/sustainable investing criteria

- Compare funds side-by-side

- Save custom screens for future use

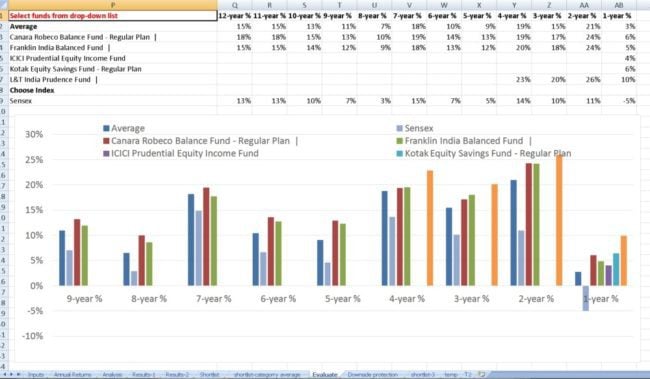

Fund Comparison Tool

Compare up to 5 funds simultaneously across all key metrics to make informed investment decisions.

- Performance comparison charts

- Risk/return metrics analysis

- Portfolio overlap visualization

- Expense breakdown comparison

- Download comparison reports

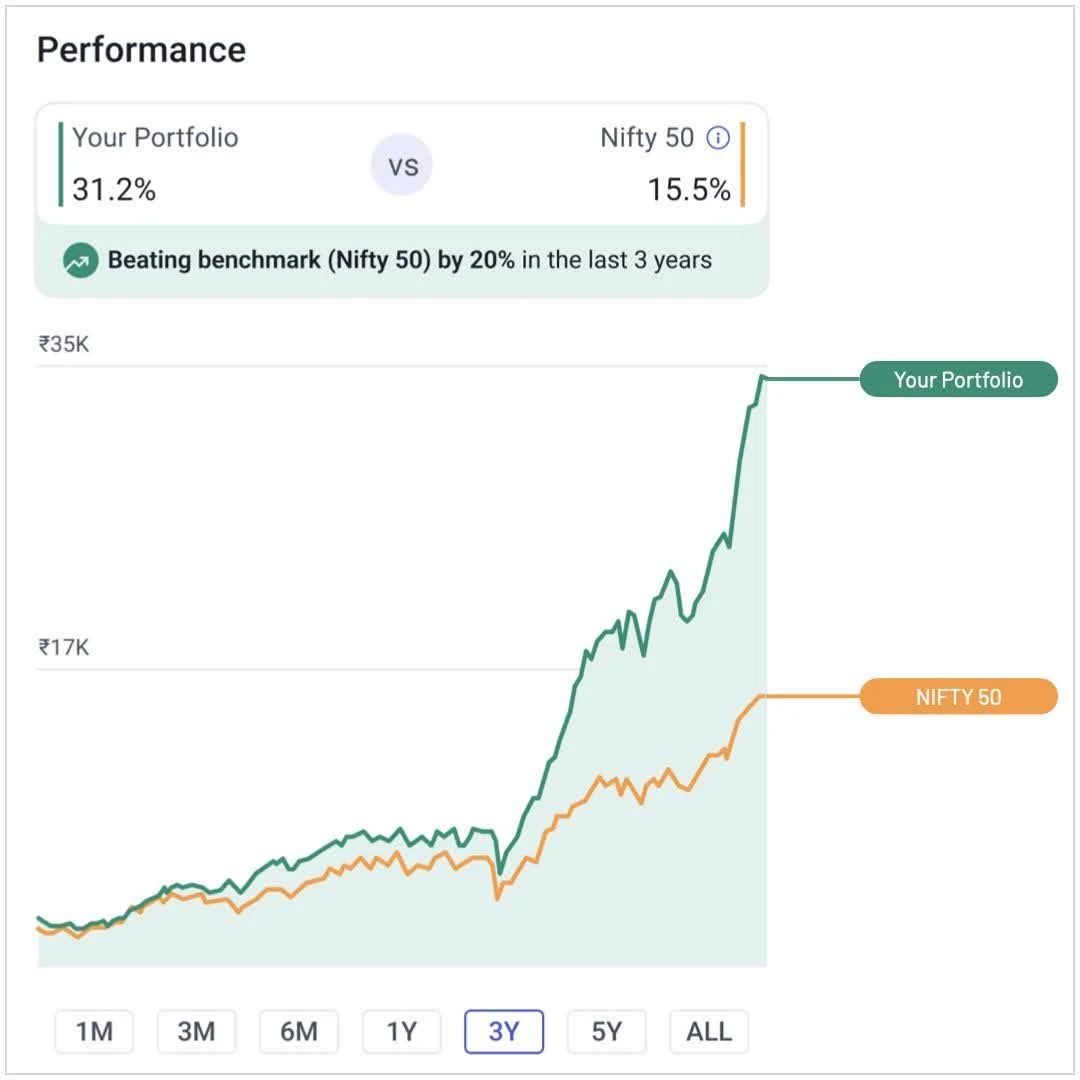

Portfolio Builder Tool

Construct and analyze a diversified mutual fund portfolio tailored to your investment goals and risk tolerance.

- Asset allocation modeling

- Risk assessment questionnaire

- Historical performance simulation

- Tax efficiency analysis

- Rebalancing recommendations