Proven Options Strategies

Explore and implement professional trading strategies

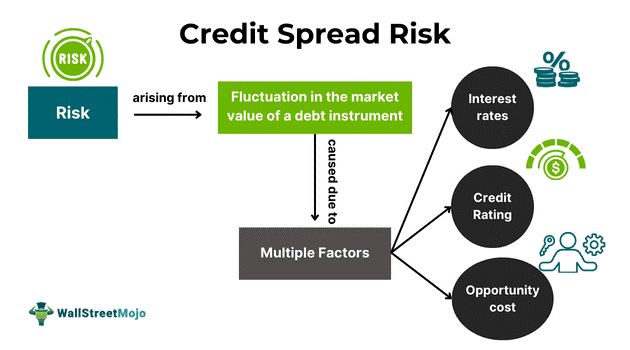

Credit Spreads

Collect premium by selling options while defining risk with long options. Ideal for range-bound markets.

- Defined risk strategy

- Benefits from time decay

- Neutral or slightly bullish/bearish

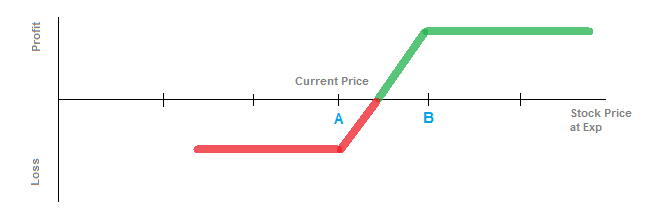

Debit Spreads

Pay a premium to profit from directional moves with limited risk. Higher probability than naked options.

- Lower cost than single options

- Defined risk and reward

- Bullish or bearish

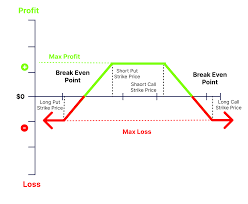

Iron Condors

Profit from range-bound markets by selling call and put spreads simultaneously.

- Double premium collection

- Time decay and volatility crush

- Sideways markets

Protective Puts

Hedge stock positions against downside risk while retaining upside potential.

- Limits downside risk

- Unlimited upside

- Crash protection