Sophisticated Wealth Solutions for Discerning Investors

Exclusive strategies to preserve, grow, and transfer wealth with our institutional-grade advisory services.

Trusted by over 5,000 high-net-worth individuals worldwide

Exclusive strategies to preserve, grow, and transfer wealth with our institutional-grade advisory services.

Trusted by over 5,000 high-net-worth individuals worldwide

Multi-dimensional solutions tailored to your unique financial objectives

Our proprietary investment framework combines fundamental research with quantitative analysis to construct portfolios that balance growth and preservation.

Minimize tax liabilities through sophisticated planning techniques tailored to your jurisdiction and financial situation.

Preserve your legacy and ensure smooth wealth transfer across generations with our expert guidance.

Create meaningful impact while maximizing tax benefits through our philanthropic advisory services.

Comprehensive wealth management solutions for ultra-high-net-worth families with complex needs.

Tailored service packages based on your assets and complexity of needs

Our proprietary investment process combines fundamental research with quantitative analysis to identify high-conviction opportunities while managing risk.

Top-down assessment of global economic trends, monetary policy, and geopolitical risks.

Strategic and tactical positioning across asset classes based on expected returns and correlations.

Bottom-up analysis of individual securities using fundamental and quantitative metrics.

Optimizing position sizing, diversification, and risk parameters.

Ongoing assessment of portfolio positioning and risk exposures.

Diversify beyond traditional markets with our curated selection of alternative assets

Access to top-tier buyout, growth, and venture capital funds with minimums starting at $250,000.

Institutional-quality commercial and residential properties through REITs and direct investments.

Strategies designed to generate alpha while managing market exposure and volatility.

Direct lending and specialty finance opportunities offering attractive risk-adjusted yields.

Curated investment opportunities in blue-chip art, rare wines, and collectible assets.

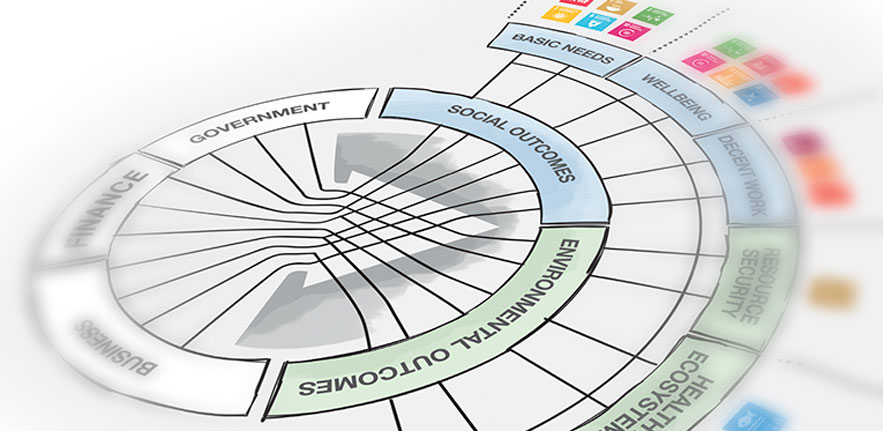

Investments targeting both financial returns and measurable environmental/social impact.

Take the first step toward achieving your financial aspirations with our personalized wealth management services.

60-minute discovery call to understand your goals and needs

Tailored wealth management plan with investment strategy

Seamless account setup and portfolio implementation

Continuous monitoring and proactive adjustments

Complete the form below and our team will contact you within 24 hours.

Schedule a confidential consultation with one of our senior wealth advisors to discuss your financial goals and how we can help you achieve them.